Background: I created this decision table based on information from FEMA’s National Flood Insurance Program. The purpose of my table was to demonstrate, in a presentation on using job aids, how this arrangement can guide people through a series of decisions and have them arrive at an appropriate answer.

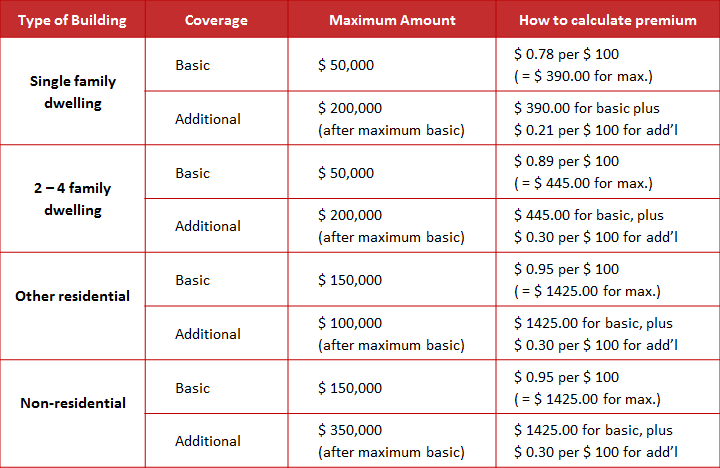

Rating (figuring out premiums) is chapter 5 of the NFIP Flood Insurance Manual and comes to more than 60 pages in the most recent edition. Even so, an insurance agent who wants to calculate the correct premium can make use of tables to determine (a) the property’s flood zone, (b) the specific type of property, (c) the coverage [desired amount of insurance], and finally (d) the premium based on the actual coverage.

I’m pointing this out to emphasize that you shouldn’t use my table to figure out what your flood insurance might cost. You can use it as a simplified example of a decision table, though.

What’s the accomplishment? A quotation for the annual premium for flood insurance, accurate based on the type of property, the desired amount of coverage, and the overall limits for coverage.

Who’s the performer? An insurance agent writing a flood insurance policy under the National Flood Insurance Program.

More about this job aid:

- As noted above, this is a simplified example used in a discussion about types of job aids. It’s not meant as an exhaustive guide to determining flood insurance premiums.

- The decision regarding premium involves three main sets of conditions, represented by the first three columns on the left:

- What type of property is this?

- What level of coverage is the client seeking? (The NFIP has two levels: basic coverage, up to a given amount, and additional coverage beyond that. Additional coverage requires you to have the maximum amount under basic coverage.)

- Given the type of coverage, what’s the maximum amount sought? (Both basic and additional coverage have upper limits. The total possible coverage for a given type of property would be the maximum amount under basic coverage plus the maximum amount under additional.)

During my recent presentation at the CSTD conference in Toronto, a volunteer using this job aid was able to describe correctly how she’d calculate the insurance premium for $150,000 of coverage on two-family duplex ($445 for the first $50,000, according to the table, and $0.30 per $100 for the additional $100,000).

Even if she’d been incorrect, just a little feedback on how to compute the premium would have been sufficient for her and for all the other participants to calculate any amount covered by the chart. In fact, when I asked if I could get $750,000 in coverage for an office building, several participants immediately said no, because the maximum coverage for commercial property is $500,000.

That’s a pretty good example of how a job aid improves the effectiveness of training.