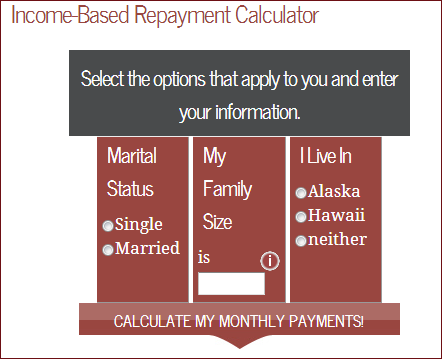

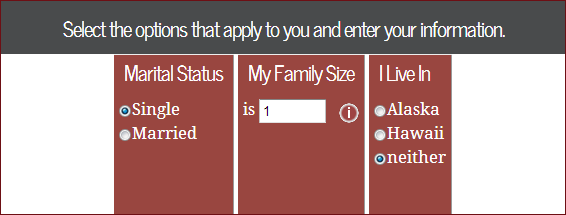

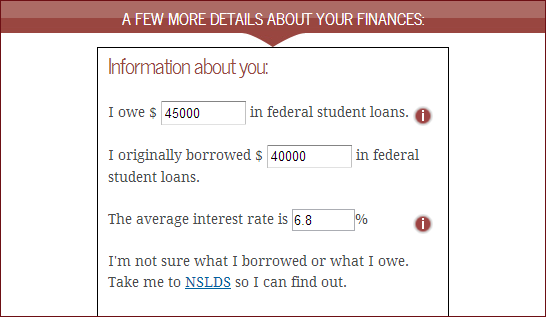

Documents and other tools that the public interacts with are a kind of performance support; the goal is to help people accomplish things they want or need to do. Job aids are one form of performance support, and I see a ballot as a kind of collector worksheet (as opposed to one that helps calculate): information on the ballot form is organized, typically by office or issue, and the voter has a way to indicate her selection.

The Center for Civic Design has for its goal making “every interaction between government and citizens easy, effective, and pleasant.” I’ve just come across a post of theirs from 2008 that discusses in depth a usability test for state ballots in New Hampshire.

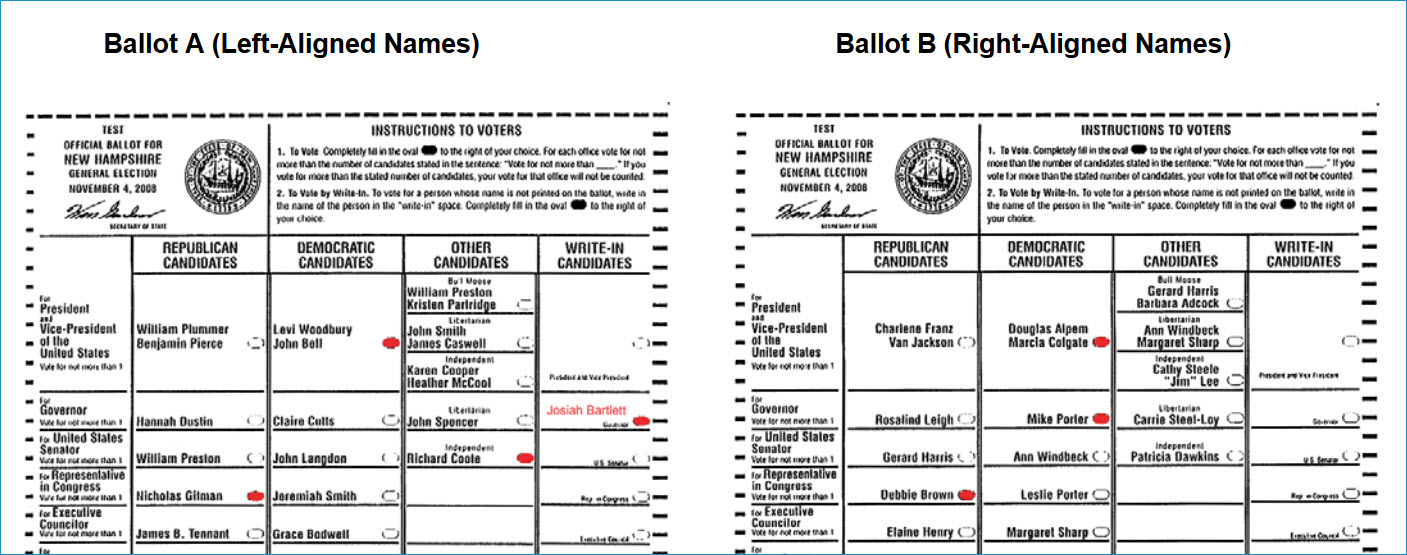

The test looked at a single question: is it better to left-align the names of candidates, or to right-align them so each name is as close as possible to the circle that the voter would fill in?

From a performance improvement viewpoint, and as someone who’s worked as an election judge several times, I found the discussion in the full report enlightening. As for the conclusions, participants in the test who used Ballot B:

- Took slightly less time to vote.

- Made fewer errors.

- Preferred Ballot B to Ballot A.

From CCD’s conclusions:

Although the difference in the number of errors made by participants when voting on Ballot A and Ballot B is not statistically significant, the data indicate that there is a trend toward fewer errors when voting on Ballot B. For this reason, we recommend the use of Ballot B (right-aligned names) for the general election in November.

A strong proximity relationship between candidate names and fill-in ovals is more important than the alignment of names on the ballot.