About this job aid

The Office of Federal Student Aid is part of the U.S. Office of Education. Part of its mission is to inform students and families about federal student aid programs.

Students with certain federal loans who are experiencing financial hardships may be eligible for the Income-Based Repayment plan. An IBR can lower the required monthly payment, though it can extend the payment period and thus increase the total interest paid.

As part of its information about load replayment, the Office of Federal Student Aid has an online calculator to determine the likely monthly payment under an IBR.

This is a calculator job aid–based on information entered, it performs calculations and produces an answer. In this case, the answer is an estimated loan payment.

What’s the accomplishment?

Determining the monthly payment for a student load under an Income-Based Repayment plan.

Who uses this job aid?

Anyone trying to determine this figure; most likely someone with a student loan who’s having trouble making the payments.

Using the calculator

Preliminary information:

There are many kinds of student loans, and not all are eligible for an IBR plan. On the same page as the calculator, Federal Student Aid states:

Your loan servicer will determine your eligibility for IBR, but check this calculator to see whether you might qualify and what your estimated payment could be.

In addition, there’s a link to the National Student Loan Data System so that a person with a student loan can determine which type of loans he has, along with the current amount of principle and interest.

Finally, the page suggests having on hand income information like your most recent federal income tax return.

The calculations:

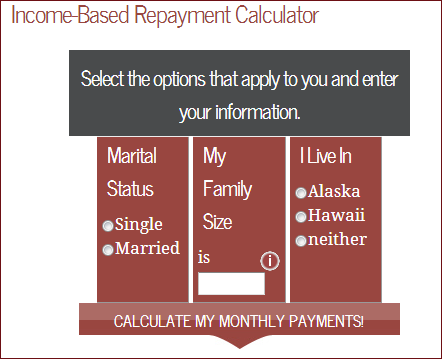

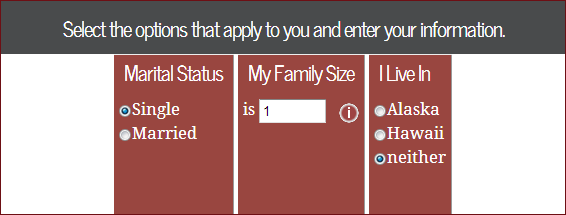

As the first step, I entered marital status, family size, and location, using an example in the FSA FAQs (single, living alone, in Maryland).

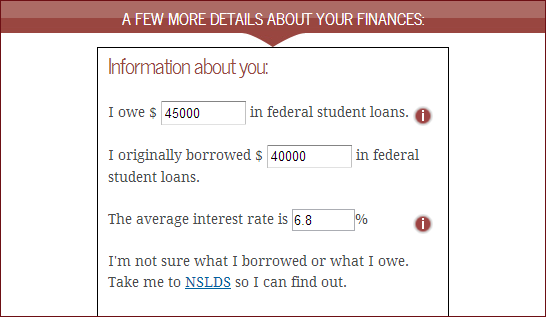

Next, I enter details about my current loans:

After that, I enter income data based on my (hypothetical) tax return.

Based on the data I provided, the calculator says I may qualify for a monthly payment of $309.

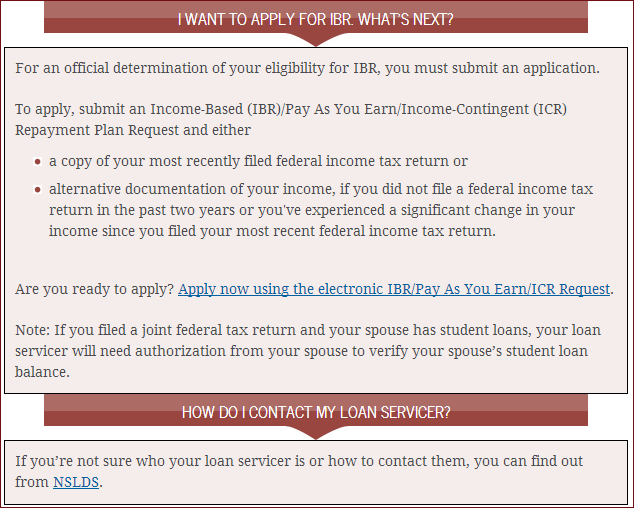

The calculator then provides information about the next part of the process:

Comments / critique

Adaptive approach

When you see the calculator, it looks like the first image in this post: just the space for marital status, family size, and location. Only after you enter that data does it expand to ask for income data, and only after you enter that data does information appear for the estimated monthly payment and for the next steps to take.

Considering the complexity of the subject, that’s a good approach for the calculator to take. It’s less intimidating at the outset.

Embedded help–less than helpful?

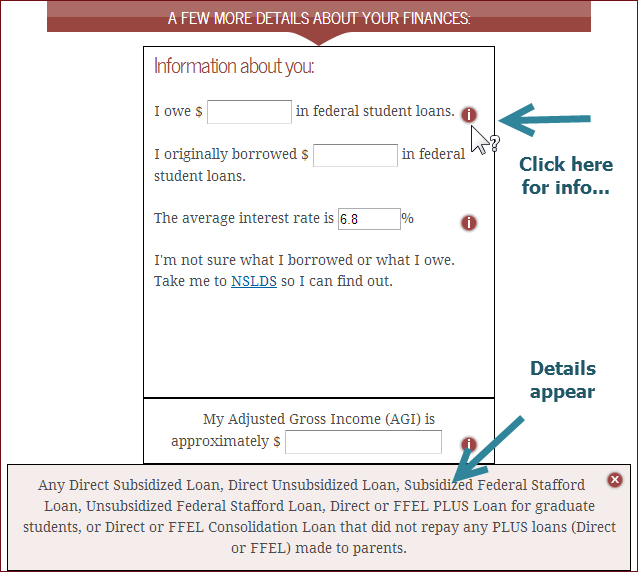

I did find it a little confusing to read “I owe [amount] in federal student loans” and “I originally borrowed [amount] in federal student loans.” When I clicked the icon for more information, at first I thought I had a problem with my browser. It took me a while to realize the information appeared further down the screen than I expected:

That image is 570 pixels high, and on some computers might not be obvious.

Other resources

- The Federal Student Aid site has detailed information about Income-Based Repayment plans.